Researching and Building a Sales Journey Map of Lowe's B2B Pro Customers

Case Study | Leo Vroegindewey | 2020

Highlights

- The enterprise sales journey map identified 100 opportunities that could drive business growth across Lowe's US$3B Pro contractor customer segment.

- The research identified two strategic themes that could significantly boost Lowe's sales revenue and brand reputation if exploited properly.

- Theme: Predictive selling material packages to contractors.

- Theme: Simplifying the legacy sales quote process internally and externally.

- Important touchpoints of the sales journey could, for the first time, be acted on in unison across the entire technology organization because of the breadth of this journey map.

Introduction

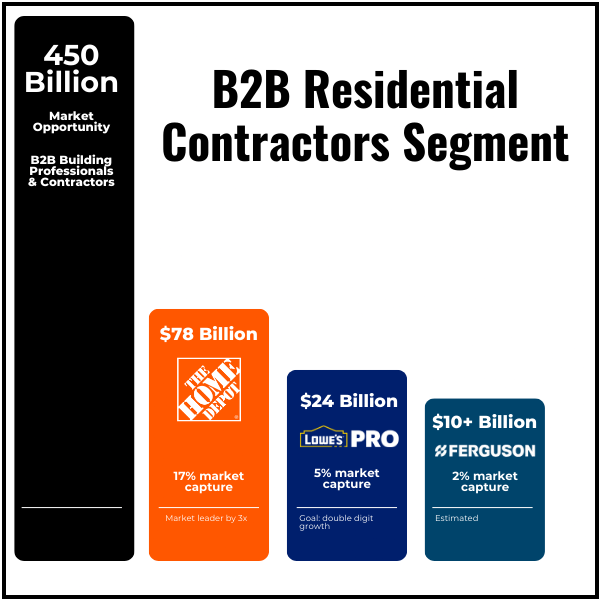

The fact that Home Depot (HD) had a massive lead over Lowe's (LOW) when it came to selling building materials to the B2B contractor segment was no secret. Each year, Home Depot generates approximately $54B more sales in the B2B contractor customer segment than Lowe's, and Lowe's leadership wanted that gap closed.

I wanted to build a generic sales journey map of the Pro B2B customer segment for the Lowe's store technology organization, and I wanted the Pro sales business team to base their business strategy decisions coupled with financial data and future investments on this map.

The sales journey map would follow a B2B residential contractor looking for residential projects. When they find materials that match their primary business capabilities (build, repair, renovate) and their skill set (trade), contractors purchase those goods for their project and intend to start and finish as quickly as possible so they can move on to the next one.

I wanted to use this Pro contractor sales journey map to uncover new innovation and growth opportunities that Lowe's could exploit to benefit the customers and their businesses.

Business problem

Grow Lowe's Market Share in the Pro B2B Segment

When your competitor generates $54B more in sales from a customer segment to which you also sell, you need to rethink your business strategy to make significant inroads into that segment.

Home Depot generated more sales in the Pro B2B contractor segment, and they started their digital transformation initiative much sooner than Lowe's because they realized (much like Lowe's did later) that legacy software tools become a huge hindrance when you’re evolving your customer experience and growing sales in particular customer segments.

In short, not only was Home Depot generating more sales from their B2B contractor segment, but they also had a head start on Lowe's when it came to eliminating and replacing their legacy back-end tech stack. They started their digital transformation earlier and were laser-focused on the most lucrative customer segment, whereas Lowe's gravitated toward the DIY and do-it-for-me (DIFM) customer segments.

I knew that to make a considerable dent in Home Depot's sales lead in the B2B contractor segment, cookie-cutter attempts wouldn’t (excuse the pun) cut it. Also, incremental improvements in the customer experience would most likely only yield incremental sales growth. The idea that the typical incremental product-featured improvement cycle would make a difference would also not suffice.

My role

In early 2020, I was ready to take on my next project in the Pro product portfolio. This project would focus on the residential contractors who purchased building materials from Lowe's.

The Pro customer group to which Lowe's sold materials included residential and commercial contractors, which also covered colleges, companies with large rental portfolios, and many who serviced, maintained, and developed buildings.

However, I was focused on the underserved residential contractor customer group within the Lowe's Pro customer group.

My New Project: Mapping the Residential Contractor Journey

Journey mapping the B2B residential contractor sales journey was my raison d'être for joining Lowe's CUX design team as its first product designer.

Before my tech career, I had spent almost a decade in the oil and gas industry working with construction companies. I designed and developed the first health and safety iOS app for Canadian oil and gas industry construction workers, so I was very familiar with the construction industry and the different trades involved. Thus, I was ready to make the shopping experience for the residential contractors as frictionless as possible.

The Current State of the Residential Contractor Experience

I met with Pro Sales business team members, who mentioned that they wanted to unlock pro personas across the Pro platform. They hoped to figure out the user journey within Lowe’s across the portfolios—for example, the Pro customer journey mapped across Lowe's store and e-commerce teams, two prominent technology organizations within Lowe's with specific portfolios and strategies. The business team, rightfully so, wanted to ensure that the Pro journey map would show the end-to-end journey across the entirety of Lowe's.

The business team mentioned The Pro personas’ master journeys. They were particularly interested in the following:

- Commercial persona (Property management)

- Residential persona (Property management)

- Renovator/Remodeler persona

I had high hopes that I would conduct customer/user research for this project. However, the business team wanted Customer Insights (an in-house research team that reports to the business teams and is not a part of the technology organization) to do it. However, when we had this conversation, the Customer Insights team had only one person supporting the Pro customer research.

Therefore, the business team explored hiring an outside consulting group to research the Pro customer journey map instead of the Customer Insights team. Two different consulting companies, Slalom and Highland Consulting, were vetted to see if they could execute this journey mapping project.

The Pro Sales business team selected Slalom to complete the Pro journey mapping project. I was disappointed after hearing that I would not lead this research effort; however, I had many other projects in the CUX design portfolio to lead and manage. In the meantime, I would wait for the research project's completion.

Slalom Presents Its Research

In H1 2020, Slalom completed their research. They spent between three and four months visiting different Lowe's stores and speaking with Lowe's Pro associates, who staffed the Pro desks and sold building materials to Pro customers. Their interviews and observations built up several personas profiles, including the Pro department supervisor (PDS) and Pro sales specialists (PSS).

Most of Slalom's research focused on the Lowe's employee selling experience, not the Pro contractor end-to-end customer experience. I'm not sure why the research primarily focused on the Pro desk associates’ selling experience and not the contractors buying building materials, but that is what the research readout showed.

Let me be abundantly clear: Slalom is a fine company with great people who know how to conduct research, take those findings, and make them usable.

However, the sales journey map of their completed research wasn’t actionable. I’m not sure what their specific instructions were, but unfortunately I couldn’t identify clear themes and directions from the research output.

This is a big lesson for anyone involved in research. If you spend three to four months researching, the results have to be actionable; otherwise, you just wasted a lot of money on something that will collect dust.

Actionable journey map

I needed to build this customer journey map for many reasons:

- We lacked accurate knowledge of our B2B customers’ needs.

- We lacked an artifact/living document to connect the different teams working to improve the B2B contractor segment’s purchase journey.

- I couldn’t pinpoint precisely where some of the customer frustrations lay.

- We lacked a holistic journey map for this strategic customer segment.

- I couldn’t influence product roadmaps because I couldn’t articulate where and how the opportunity surfaced.

- One-sided purchase journeys were typically displayed in PowerPoint decks, and it was hard to interact and learn from slide decks.

- We lacked an opportunity backlog that could inform the product team and our stakeholders.

- I couldn’t surface opportunities and pair them with user sessions and cohort data.

- I couldn’t synthesize strategic themes for our leadership because I couldn’t tell them where the gaps in the residential contractor experience were.

Goals of Building a B2B Contractor Sales Journey Map

Goal 2: Move the entire Lowe's store technology organization closer to the residential contractor and eliminate any knowledge gaps we had regarding how the contractors used Lowe's in their project management cycle.

I wanted to identify which specific customer tasks would increase sales revenue and improve contractor satisfaction with Lowe's. Ideally, we needed to identify the cruxes early on and target them with a series of investments.

I hoped the following activities would occur once the B2B contractor sales journey map was created:

- We’d be able to conduct shared opportunity identification workshops with other teams.

- We’d write opportunity statements together, and as a product organization we would investigate them collectively.

- We’d surface opportunities bi-monthly to Lowe's inside and outside sales teams.

- We’d leverage the sales journey map document so that all teams (beyond product teams) could use it as a springboard for investment decisions.

- We’d be able to share learnings across the broader B2B organization.

- We’d be able to drive additional customer research where needed, instead of guessing.

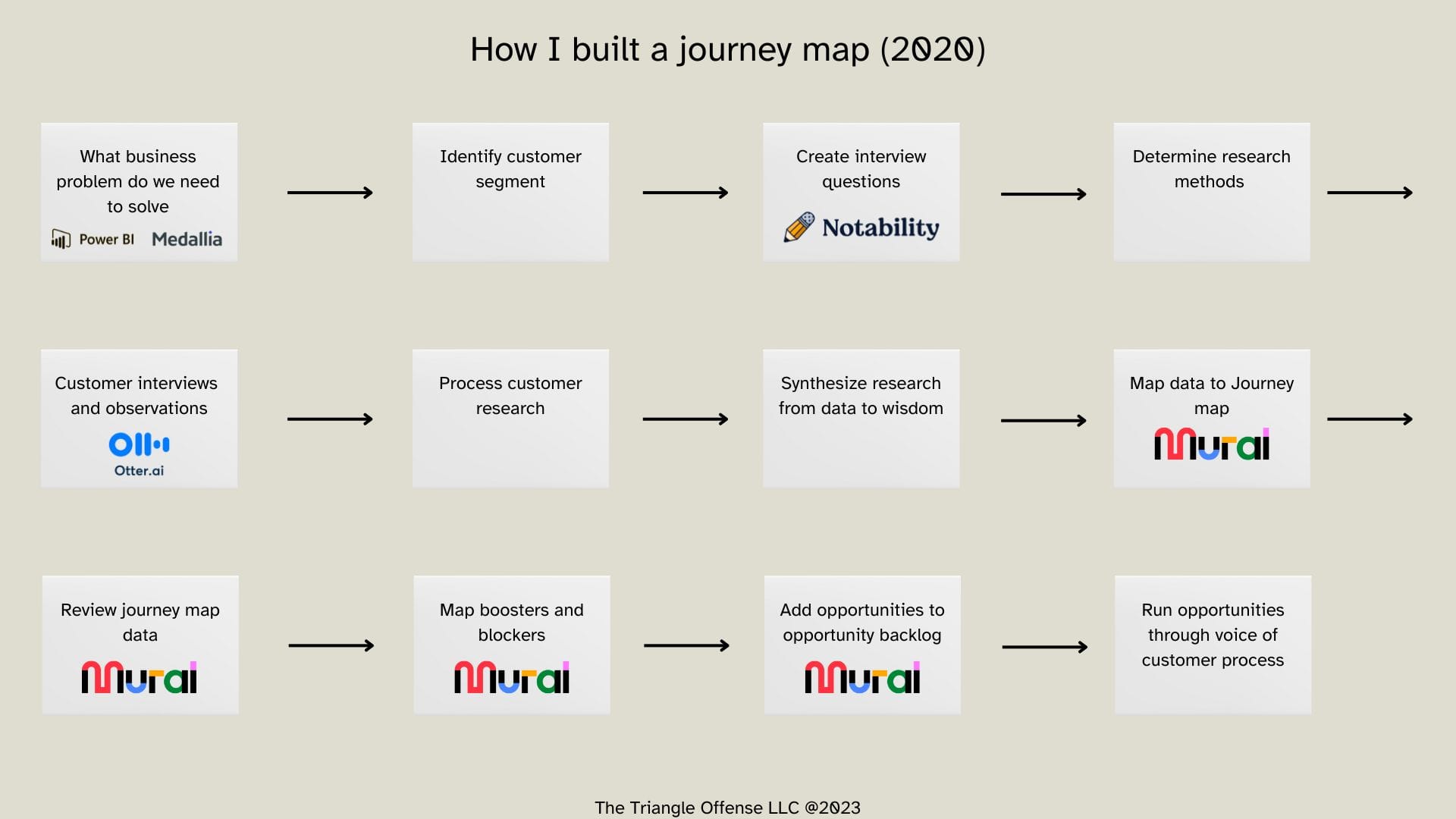

I Developed My Own End-to-End Sales Journey Map

In H2 of 2020, I spent my summer visiting different Lowe's stores in Montana, where I frequented four Pro desks and interviewed the Lowe's associates who manned them. I also read every scrap of research Lowe's had previously conducted on the Pro customers.

My approach was different than Slalom's research approach. I interviewed the following:

- Lowe's Pro associates (employees working at the Pro desk)

- Residential contractors (GCs, handymen, all trades, etc.)

- Clients who had used contractors in the past

Research

Customer and Lowe's Associate Research

Before I worked in the tech industry, I worked in the Emergency Medical Services (EMS) on an ambulance. I had the opportunity to question hundreds of people monthly in the back of the ambulance, and I've carried that experience and skill set to the customer interviews I conduct in the tech field.

As an EMT/paramedic student, you’re taught to always ask open-ended questions when talking with your patient(s), but this skill takes time to learn. Extracting information is an art; once you've spoken to a thousand people, you start to get the hang of it.

I break down my interviews between global and follow-up questions that get to the heart of a process I want to understand. I want to be able to pivot depending on where I meet the interviewee. I don't run a standard script; I improvise on the fly, depending on the situation.

Following is a description of the interview questions I asked the residential contractors, so I could understand their work better.

Global Interview Questions

- Tell me about what kind of work you do?

- Walk me through a typical scenario where someone contacts you for a job.

- What is it going to take to get your business?

- Their product choices (How do they evaluate)

- What type of customer are you looking for? (Tell me more)

- Types of work they do (Respond with, tell me more)

- Probe (What drives the other? Look for loops; for example, what type of customer are you looking for - what drives this need?)