Developed a sales-optimizing VoC program for Lowe's B2B customers

Case Study | Leo Vroegindewey | 2020 - 2022

Highlights

- Developed the first known VoC program at Lowe's.

- Led and managed a VoC program that impacted a product portfolio in Lowe's technology organization.

- Linked the VoC program to the Pro product portfolio, enabling a customer-centric approach to coordinate product team priorities.

- Used the VoC program as a resource allocator. I was creating a much more effective and budget-friendly approach to managing work.

- Used the VoC programs to programmatically surface strategic themes on improving the most important & addressable areas of the Pro customer experience.

- Aligned product teams in a highly matrixed environment and assisted in creating quarterly release plans that were completed on time.

- Leveraged the VoC program to create a continuous discovery process that could generate target states with minimal effort.

"Leo is a true leader. He understands how to partner across the enterprise to get things done."

Eli Wendkos – Lowe's, Director of Product Management

Introduction

In H2 of 2020, I was a lead product designer working on improving the Pro customer shopping experience at Lowe's and the sales experience of the Pro Sales Specialists. The question that was top of mind for me was, what could I do to help increase Lowe's market share in the Pro customer segment? How could I help Lowe's sell more building materials to residential contractors? And how could I improve the customer experience so that contractors would be happy and satisfied with their interactions at Lowe's?

Lowe's generates approximately US$24B in sales from their Pro customer segment. This pales compared to Home Depot, which generates US$78B from the Pro customer segment. The B2B construction market is massive; the total addressable market (TAM) of the home building contractor market is estimated to be more than US$625B. Lowe's wanted to increase sales generated from that customer segment since the average transaction of the Pro was much higher and more frequent than the DIY customer segment.

I knew the path to increase sales revenue and market share was to design an organization centered around the customer.

This may seem obvious, but it was my experience that many tech companies are centered around their product and not the customer. Their organization's design ensured that it would never happen if there were a chance to improve their customer experience radically because their organization was built to deliver incremental value every quarter. I intended to ensure that the Pro product portfolio would be the most customer-centric in Lowe's technology organization.

After a lot of research and reading many books on managing a brand's customer experience of a brand. I concluded that a Voice of the Customer (VoC) program would be the organizational advantage that would unite the Pro portfolio product and business teams to identify the most pressing needs that would make a real difference in Lowe's Pro customer shopping experience.

At first, the program I had in mind wasn't called a VoC program. It was called the opportunity portfolio V1. But my objective was clear. I needed to design an organization centered around the customer and could listen and improve the Pro customer experience systematically.

This case study is the story of how I built a VoC program. The process, the ups, and the downs, what worked and what didn't.

Timeline

In 2020:

- July-Sept: Research Pro customers and Lowe's Pro associates

- Oct-Dec: Synthesized customer, associate, market research

- Dec: Developed Pro B2B residential contractor journey map

In 2021:

- January: Garnered support to build VoC program

- February: Initiated VoC program

- March-Dec: Managed VoC program for the Pro product portfolio (Stores)

In 2022:

- February: The end of the VoC program due to a Lowe's reorganization.

The business problem

The Pro Sales business team indicated their top priority was improving the shopping experience of the B2B residential contractor buying building materials from Lowe's. There were two important reasons why the Pro Sales business team decided to review the current state of the contractor shopping experience at Lowe's.

- Increase market share: Home Depot (HD) generated three times more sales from the contractor segment than Lowe's. The Pro Sales business team wanted to increase Lowe's market share in the Pro customer segment. (HD: US$78B, Lowe's: US$24B)

- Increase revenue: The contractor customer segment shopped more often and bought more products during each store visit. Their average order value (AOV) was significantly higher than the do-it-yourself (DIY) and do-it-for-me (DIFM) customer segments.

To this day, I am unsure if the financial performance and projections were key drivers in shaping the Pro Sales business team's strategic planning. Or if it was the fact that Home Depot was generating more sales than Lowe's and their market share was three times the size of Lowe's.

One thing was for sure. The Pro Sales team needed to understand the B2B contractor shopping experience with Lowe's. They wanted to know where to improve the customer experience so that more contractors would buy building materials from Lowe's.

What is a VoC program?

A VoC program is a systems management approach to listening, capturing, analyzing, and responding to customer feedback and research and using a continuous design process to work through identified opportunities to improve the customer experience.

The need for a VoC program

It was a store-led growth (SLG) business. Lowe's preferred to sell through their 1,700 plus stores and had started investing in other sales channels such as the app and web in 2015 and beyond.

This different investment strategy exposed gaps in the omnichannel buying experience of the B2B contractor segment. Lowe's Pro associates and customers expressed frustrations about numerous deficiencies or missing touchpoints littering the customer and associate experience.

Whether Lowe's realized it or not, it had become an omnichannel retailer and had no choice but to become a CLG organization if it wanted to survive.

My role

I led the design vision for a large product portfolio.

As the lead product designer and most senior IC designer, I managed the projects and design operations in the Pro product portfolio in the Store technology organization. I worked alongside three product management and engineering directors.

I oversaw the design work for the following products and areas:

- Lowe's Pro Supply website (Link)

- Lowe's MVP Pro Rewards Program website (link)

- eProcurement products (Link)

- Quote Support Program (QSP) products (Link)

- Installation services products (Link)

- Inside and Outside sales & CRM products

I worked in a complex matrixed organization.

I worked with 15 product managers in the Store's technology organization and coordinated the design work in their product roadmaps across three customer segments.

I mainly worked with the Pro Sales business team. Who managed the following Pro groups:

- Pro Online

- Loyalty Experience

- MVP Pro Rewards

- Business Tools

- eProcurement

Why build a VoC program?

As a lead product designer at Lowe's and leading the design vision for the Pro portfolio in-store technology organization, we were in the midst of a company-wide digital transformation. One particular company that inspired many people at Lowe's during our digital transformation was Target.

Target, a retailer with a market capitalization of $62.4B and annual sales revenue of $109B, started its digital transformation in 2017 and successfully created an agile culture where it encouraged innovation and digital transformation which led to an explosion of digital sales. Target had leaped, becoming an omnichannel retailer successfully; aided by their agile processes and pandemic spending, they saw a 45% YoY growth in sales.

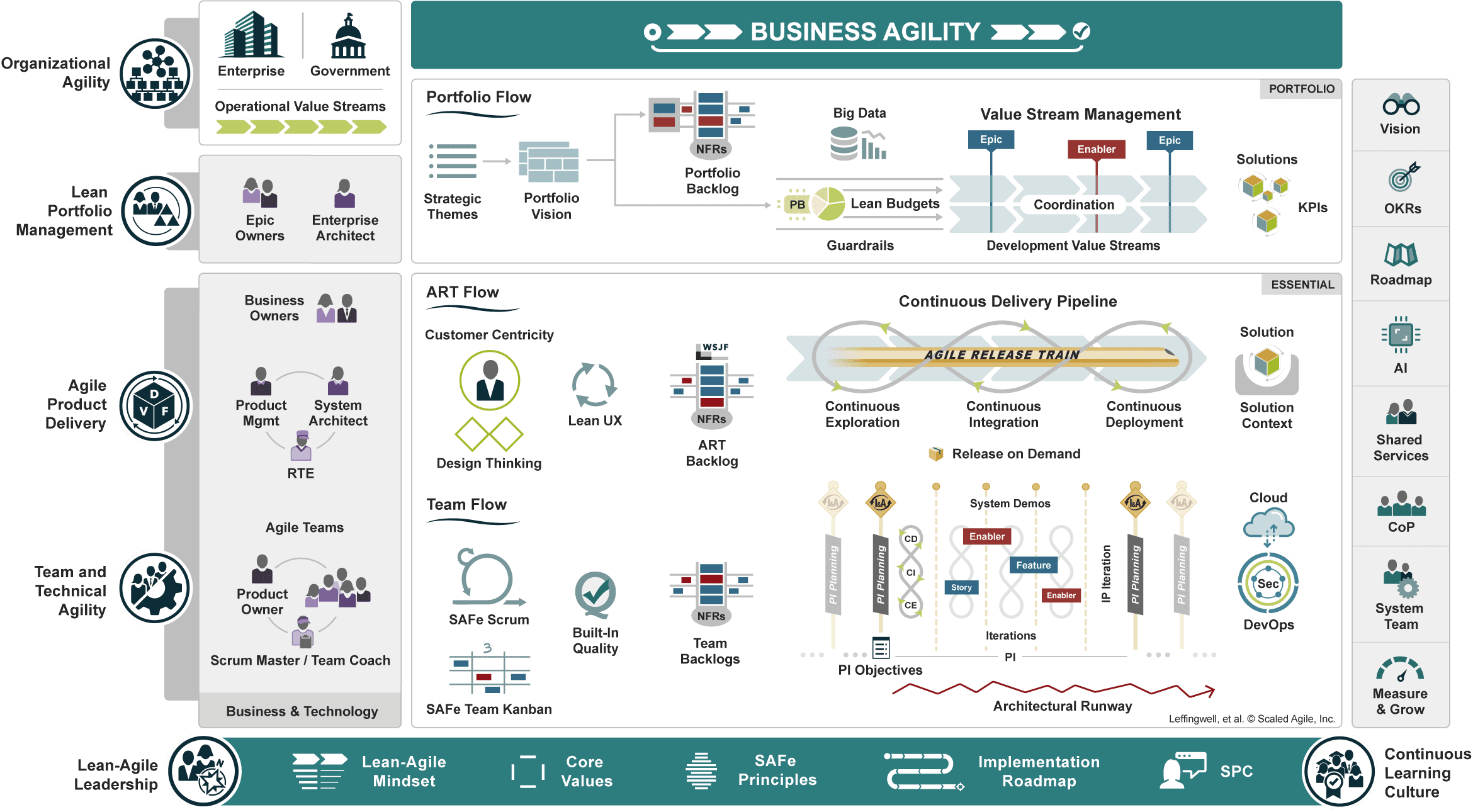

Inspired by Target's agile Dojo concept, Lowe's CEO Marvin Ellison, who joined Lowe's in July 2018, initiated a digital transformation at Lowe's. He approached Seemantini Godbole from Target and appointed her chief information officer (CIO) to oversee the technology organization at Lowe's. Lowe's hired consultants to assist in implementing the Scaled Agile Framework for Enterprise (SAFe) across Lowe's technology organization.

#1 Disconnect between strategic themes and portfolio vision

I managed the design work in the Pro portfolio and set the design vision. I observed a gap between the strategic themes and portfolio vision steps within the SAFe process.

Since 2019 Lowe's leadership has created an annual strategy and laid out a series of themes steering the lines of business toward execution and alignment with Lowe's long-term broader objectives and vision.

Utilizing the SAFe framework, Lowe's leadership expected that the senior leaders leading product portfolios would align their portfolios to ensure all objectives were met. This was a reasonable expectation, and in many cases, that is exactly what happened across several product portfolios.

However, the successes of the product portfolios were predominantly incremental improvements to the broader shopping experience. For example, important areas in the Pro customer experience could not be addressed because product portfolios were split despite appearing to be one entity.

As a result, only incremental improvements could be made to the customer experience of the Pro because opportunities linked to our broader strategy became gridlocked in Lowe's heavily matrixed environment.

We could not operationally move the needle and exponentially improve the Pro customer experience driving more sales revenue and grabbing more market share from HD. Many team members of the store technology organization quietly struggled with the product roadmap gridlock in a heavily matrixed environment where it appeared there was no immediate solution in sight.

#2 Navigating the shift from in-store sales to omnichannel sales

Organizationally, Lowe's had not yet realized that splitting the Pro customer experience into two teams with different incentives would create a technology organization with two distinct strategies.

Lowe's technology organization was divided into store and e-commerce groups. I was part of the store technology organization. This meant that for every quarterly planning, we would have to liaise with the product team members from the e-commerce technology organization.

In the store technology group, we were dominated by requests from the store operations team, who were heavily focused on the customer experience in the store and very focused on running a Pro desk from an operations perspective.

In the e-commerce technology group, the Pro Sales business team was the dominant voice that focused on directives from their Pro VPs—coupled with legacy infrastructure powering the internal software that the associates used and the shopping experience on Lowes.com that they were trying to steer the contractors to.

From books to action

There were moments during the development of the VoC program that people would ask me, "Hey Leo, how do you know that this is the right way to do it?". I am unsure if there was a right way to build a VoC program.

But people didn't see that I spent my evenings during the week studying books and reading white papers, piecing together what I thought would be the right way to build the VoC program for the Pro product portfolio at Lowe's. Whenever I figured out a new process or concept I wanted to test in our design team or our broader Pro organization, I would run it by Jon Ochenas, the senior UX manager I worked with.

He was a great sounding board for me and a trusted partner with whom I worked closely. Looking back now, I realize how important my partnership was with Jon. When I build my next VoC program, I will partner with someone like Jon, who can give me an outside perspective, assess my ideas, and look for holes in them.

If you haven't noticed by now, my secret weapon is reading books and applying them to my work environment. I didn't have a mentor or someone to teach me how to build a VoC program. So, I looked to books to help complete my objective. Below is a list of books and white papers I read and used to build the VoC program at Lowe's.

Systems management books

- After reading a white paper from Dominic Cummings on ‘Systems engineering’ and ‘systems management,' I knew that applying systems thinking was the key to success.

- From the outside, a VoC program can appear chaotic and have too many moving parts. Systems management helped me remove complexity and only focus on what was actionable and required.

- After reading up on this systems management, I concluded that running a product portfolio with eight or more products could only be run via a systems management approach and as an extension of the VoC program.

- I knew systems management had proven itself in the early 1950s and 1960s when America built the ICBM program and put a man on the moon in 1969. Running a product portfolio is not nearly as complex as running the Apollo program. Hence, I knew I could apply operational practices such as implementing a strict meeting cadence, which would increase the odds of success of the VoC program.

- The other thing I learned while reading up on the Apollo and IBM programs was the intense politics and bureaucracy in the background of those programs. I learned much about how systems management operators dealt with harmful and inefficient politicking that could delay or minimize desired outcomes.

- The Secret of Apollo: Systems Management in American and European Space Programs

- Rescuing Prometheus

- Chariots For Apollo: The Making of the Lunar Module

- The Systems Builders: The Story of SDC

- Developing the ICBM: A Study in Bureaucratic Politics

- Systems, Experts, and Computers: The Systems Approach in Management and Engineering, World War II and After

Customer experience management books

Typically, Directors of Customer Experience (CX) develop and manage a VoC program for Fortune 500 companies. So how could I, a lead product designer, undertake this complex project? I lacked the title and backing of a CX team and went it alone. However, I had the support of a senior UX manager I worked with and an influential director from product management. Both saw the VoC program as a force multiplier that would help run the Pro product portfolio more effectively.

- Because my background was mainly product development and UX design, I needed to understand CX. The first book on customer experience I read in early 2019 was Customer Experience Strategy, authored by Maurice FitzGerald.

- I learned that running a CX program on top of the technology organization at Lowe's that was backed by a customer journey map could act as a resource allocator. Learning this changed how I viewed PLG or current product management practices on assigning resources to build features.

- A book that taught me so much about customer experience management is Orchestrating Experiences. The authors did a phenomenal job breaking down journey maps, identifying opportunities, and processing those opportunities through several workshops. I used this book to build several workshop templates that I incorporated into the VoC cadence, and it was incredibly successful in bringing the portfolio products together.

- From what I can tell, most UX design organizations report to a VP of Design in product organizations. Based on what I learned in these books, it would be more beneficial for the company and the customers if UX designers would report to a VP of Customer Experience. It would bridge the gap between CX and UX practices, creating a more customer-centric organization.

- Orchestrating Experiences: Collaborative Design for Complexity

- The User's Journey: Story Mapping Products That People Love

- Customer Experience Strategy: Design & Implementation: Outgrow your competitors by making your business-to-business customers happier

Books on business strategy

Because I was a senior leader leading design work in the Pro product portfolio, I was exposed to Lowe's annual strategy planning. It was up to me and the other senior functional leaders to ensure that the Pro portfolio would execute the strategy after identifying opportunities to make it a reality.

Because I enjoyed learning about Lowe's business model and how it arbitraged its products across various sales channels. I first dove into understanding how strategy and opportunity identification are a company's most critical business processes. I loved being able to use the VoC program to solve business problems.

- The go-to book on a strategy I learned the most from was 'good strategy, bad strategy.' The author masterfully breaks down the concept of strategy and gives a lot of different examples of the concept, creation, and execution of strategy.

- Figuring out a strategy for a company starts with a business problem. But here is the thing: customers can help your business solve that business problem you want to solve. So you are back to square one, where strategy, business problem definition, and customer experience form the foundation to make a business profitable and delightful to interact with as a customer.

- Discovery-Driven Growth, written by Rita McGrath, helped me connect the VoC program to the concept of an Opportunity Portfolio. One of the difficulties I encountered was how I could connect the VoC program-identified opportunities to an internal investment process that would be able to allocate resources to an opportunity.

- Seeing Around Corners: How to Spot Inflection Points in Business Before They Happen

- The Entrepreneurial Mindset: Strategies for Continuously Creating Opportunity in an Age of Uncertainty

- Discovery-Driven Growth: A Breakthrough Process to Reduce Risk and Seize Opportunity

- Strategy: The Art and Science of Strategy Creation and Execution

- Team of Teams: New Rules of Engagement for a Complex World

- Good Strategy, Bad Strategy: The Difference and Why It Matters

Books on User Experience (UX) Design

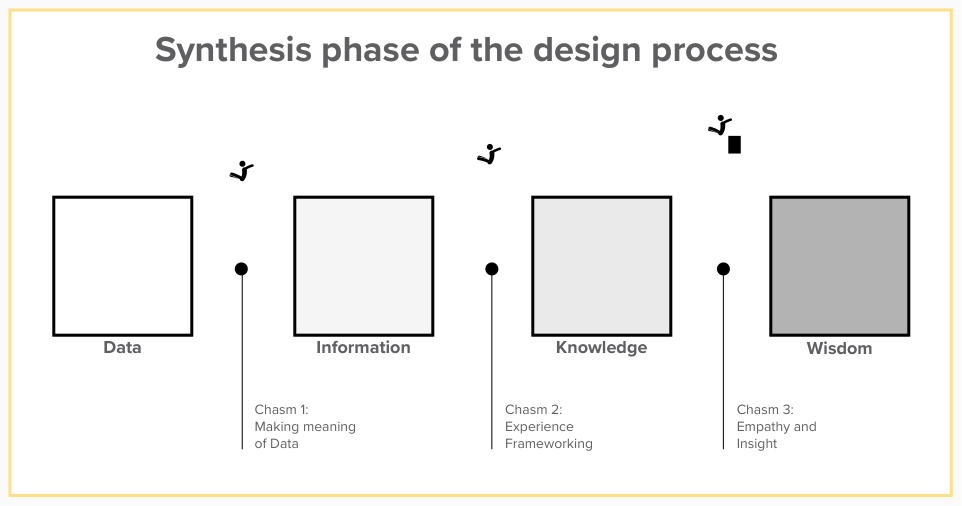

In the context of the VoC program, I was very focused on managing design activities and the synthesis phase within research and design activities. I did value user interface design (UI), but only insofar as the UI is accessible and responsive. Visual design is becoming increasingly an operational activity versus UX, which is still a collection of synthesis activities.

When building a VoC program, you are running a repeatable process that needs to give participants time to think. They need to be able to synthesize, ruminate on the idea of the opportunity, and then come up with a creative solution to solve the opportunity and, in effect, solve the business problem if required.

A VoC program runs counter to quarterly planning and release's hurried but incremental pace. It's supposed to act like an oasis where people can think through the potential opportunities that require deciding whether to invest in them.

- I could speak for hours about these books and how they influenced me. Two concepts stand out for me.

- Data from research goes through stages and eventually becomes wisdom you may want to act on. This runs completely counter to how most research data is treated.

- Second, the design process described in Notes on the Synthesis of Form completely changed my thinking about the design process. Too often, UX designers are boxed in by the mental constraints of listening to people who only design software. I found myself drawn to the design process of architecture and found clarity and efficiency that I had not seen anywhere else.

- Exposing the Magic of Design: A Practitioner's Guide to the Methods and Theory of Synthesis

- Design Methods

- Notes On The Synthesis of Form

- Creative Selection: Inside Apple's Design Process During the Golden Age of Steve Jobs

Books on product development

After running my own SaaS startup from 2013 to 2016 and designing and guiding the development of an iOS app and a web application, I had a good grasp of product management (PM) and the product development process.

The important thing I wanted to solve was which product development documentation I needed to use in the VoC program when reviewing opportunities. And then, after the team had prioritized an opportunity, what PM documentation needed to be completed?

When running a VoC program, I favor use cases to communicate the business value of an opportunity we want to build software for. A use case from my experience was better at communicating the business value to engineering and the PMs.

At the same time, designers struggled with use cases because they had been taught that user stories were the go-to documentation style to convey business requirements. But the design team learned to work with use cases, and once they got the hang of them, it was pretty easy to write them.

- The Product Manager's Desk Reference 2E

- Write a Use Case: Gathering Requirements that Users Understand

- Turn Ideas into Products: A Playbook for Defining and Delivering Technology Products

Books on change management

Not only was Lowe's in a digital transformation, but when I created the VoC program, I added another new thing for the Pro portfolio team to become familiar with. One thing was how I would sell the VoC program and get buy-in from key stakeholders. But then pulling in all the PMs was another challenge.

I understood that change management methods would need to be applied to run a VoC program successfully in a product organization. A product manager is taught to think a certain way, and CX methodology is new to most of them.

It's a good thing there are books on every topic under the sun, including how to manage transitions and cope with change. I found this book useful, and inspired me to become more aware of team members who felt overwhelmed and didn't understand the need for another program that required meetings for them to attend.

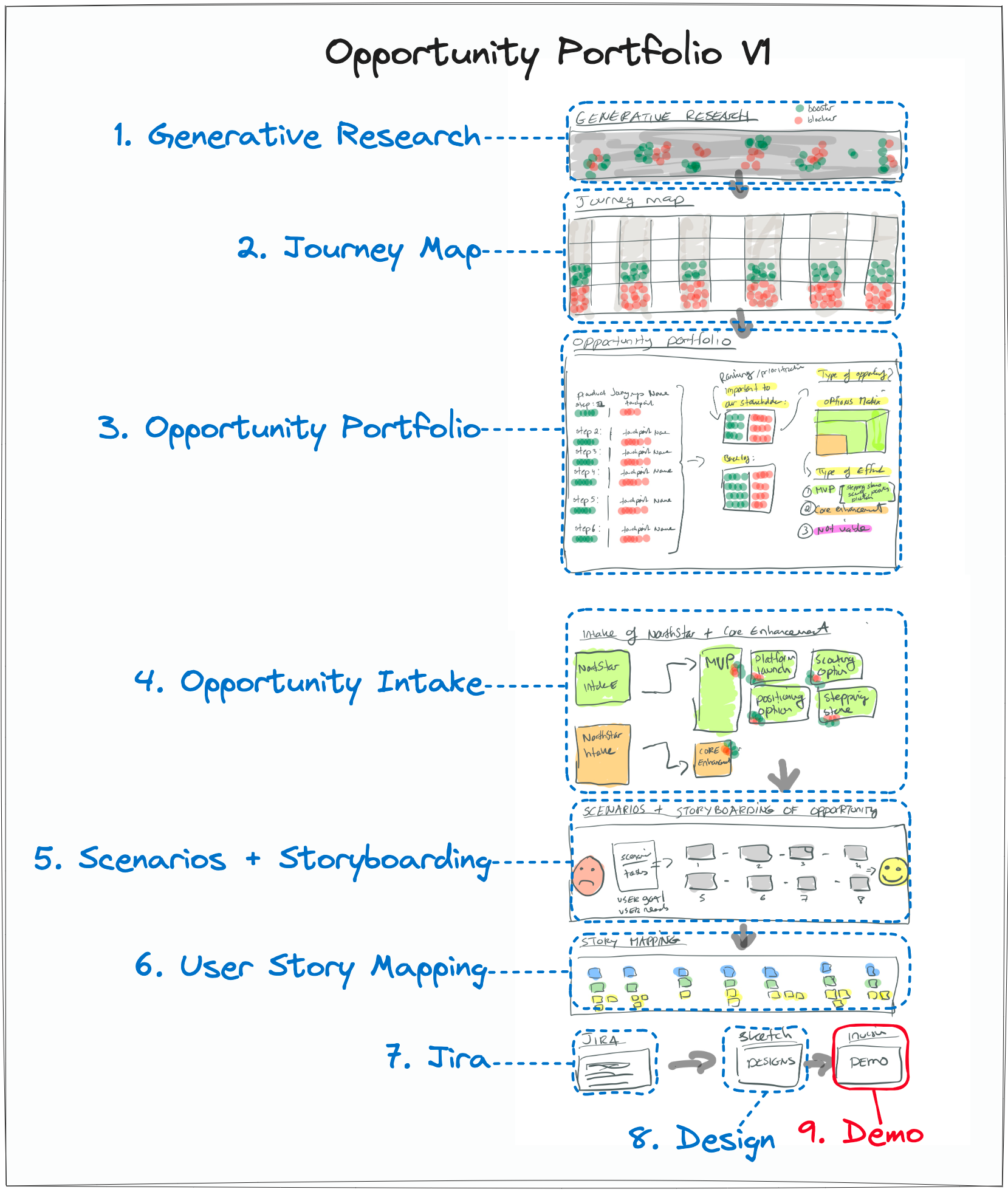

A first draft of my VoC program

I spent months reading the books on this list and taking copious notes trying to figure out what a VoC program could look like. I called the first version of my VoC program the Opportunity Portfolio V1. I sketched the outline of the program sometime in late 2020.

I made significant changes to this version because it did not combine the product development and business strategy processes in a way that I thought would work across a matrixed organization.

Initially, there were two problems I wanted to solve for.

- The VoC program could not be a standalone between software development and business strategy processes. It had to form the nerve center between customer needs and business outcomes. It had to be connected to the product development and business strategy investment processes. If I could accomplish that, the success of my VoC program would be guaranteed. It would also fundamentally change how we fund new initiatives, something I was keenly interested in doing.

- I needed to run a flawless continuous discovery cadence. But to make that a reality, I had to bridge the prioritized opportunity across this chasm between the VoC program and the discovery process. Product management did not understand continuous discovery because they were focused on executing the day-to-day of building a feature. I had to figure out how to run a separate cadence of derisking an opportunity. Then that opportunity could possibly added to the product roadmap in the future.

First steps of building the VoC program

After reading through my book list, I knew I needed a visual representation of the customer journey of the residential contractor. The customer journey map would be a key CX document of my VoC program.

In the summer of 2020, I conducted all the necessary customer and associate research to build an end-to-end customer journey map of the B2B residential contractor. The journey map shows the chronological journey of a contractor working with a client, starting a residential construction project, receiving quotes from suppliers, and starting and completing their construction project.

You can read how I researched and developed the customer journey map in this case study.

I had to complete the following research activities:

-

Data collection: I spent time interviewing customers and Lowe's associates. I observed customer interactions at the Pro desk, checkout, and the parking lot.

- I reviewed previously completed Pro customer research, including Lowe's data team insights.

- I reviewed Medallia data that captured customer feedback.

- Scoured social media, including Reddit, where many Lowe's associates anonymously posted their feedback working at Lowe's.

-

Research analysis: I spent most of my time making sense of the data. I wanted to understand the cruxes of the contractor's shopping experience. What was important to them, and where could the Lowe's Pro Sales business team invest money to improve the customer experience?

- I evaluated my Pro desk research because I wanted to understand the perspective of the Lowe's associates. They interacted with contractors daily and would have a lot of insights about how contractors wanted to buy their building materials.

- I reviewed my contractor interviews and looked for repeatable loops of user tasks that were the most important according to the contractor. I wanted those loops front and center in the journey map.

- I wanted to put together a list of concepts or themes that were universal truths from a contractor's perspective. How did Lowe's fit into the world of local residential contractors?

- Lastly, I needed to map all the opportunities that would need to be reviewed by the Pro Sales business team. And I would need to identify which opportunities warranted immediate review.

Utilizing researchers

During the research stage of building the VoC program, I noticed that this stage was an excellent fit for customer and UX researchers. This plays to their strengths. I've always felt that researchers should be used on long-term projects, not on-demand for smaller research projects.

From my perspective, especially when the VoC program is operational, there would be an essential place for the researchers to join the business decision-making process. I saw a future where researchers could answer questions and fill in the gaps when the Pro Sales business team would have questions about certain opportunities they may want to invest in.

When you front-load your research team into a VoC program, it's more beneficial for the company in the long run. You want researchers to help derisk the opportunities by providing accurate qualitative data that can be used in the early stages of a business investment process.

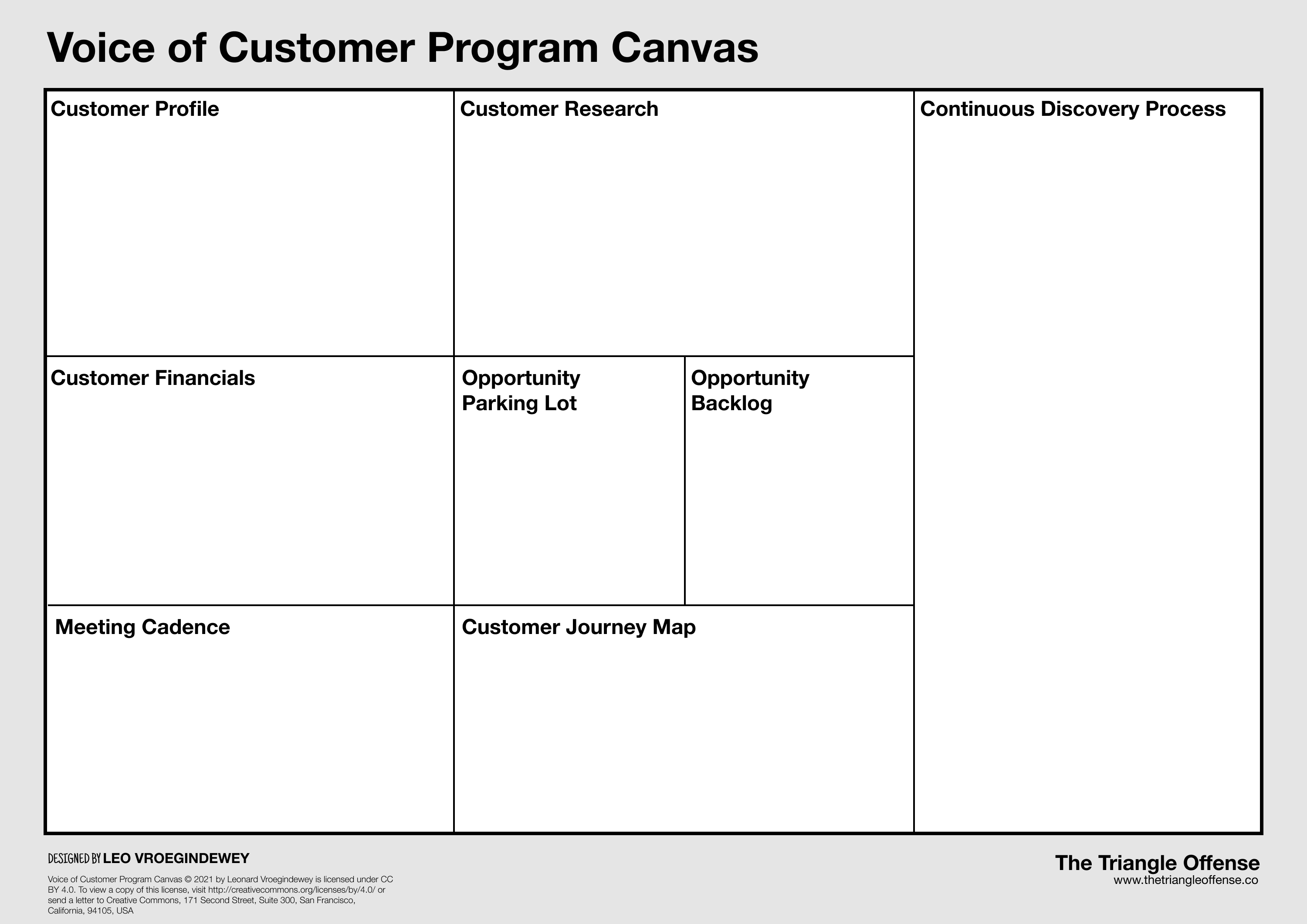

Key elements of my VoC program

The key elements that made up the VoC program were the following CX documents and processes:

- Customer profile: I knew we were focused on the Pro customer segment. The archetype I was focused on was the residential contractor (build/repair/renovate) who would purchase building supplies weekly from Lowe's.

- Customer financials: I needed to understand the financial performance of the Pro customer segment. Financial metrics like sales revenue, average order value (AOV), average basket size (ABS), average transaction value (ATV) time in the store, sales per Pro associate, and sales by Pro desk needed to be widely understood by the Pro portfolio team.

- Customer journey map: I needed to show the visual chronological customer journey of the B2B residential contractor from start to finish. I need this CX document to anchor opportunity identification and prioritization activties. I needed the Pro portfolio to be customer-centric in all their decision-making.

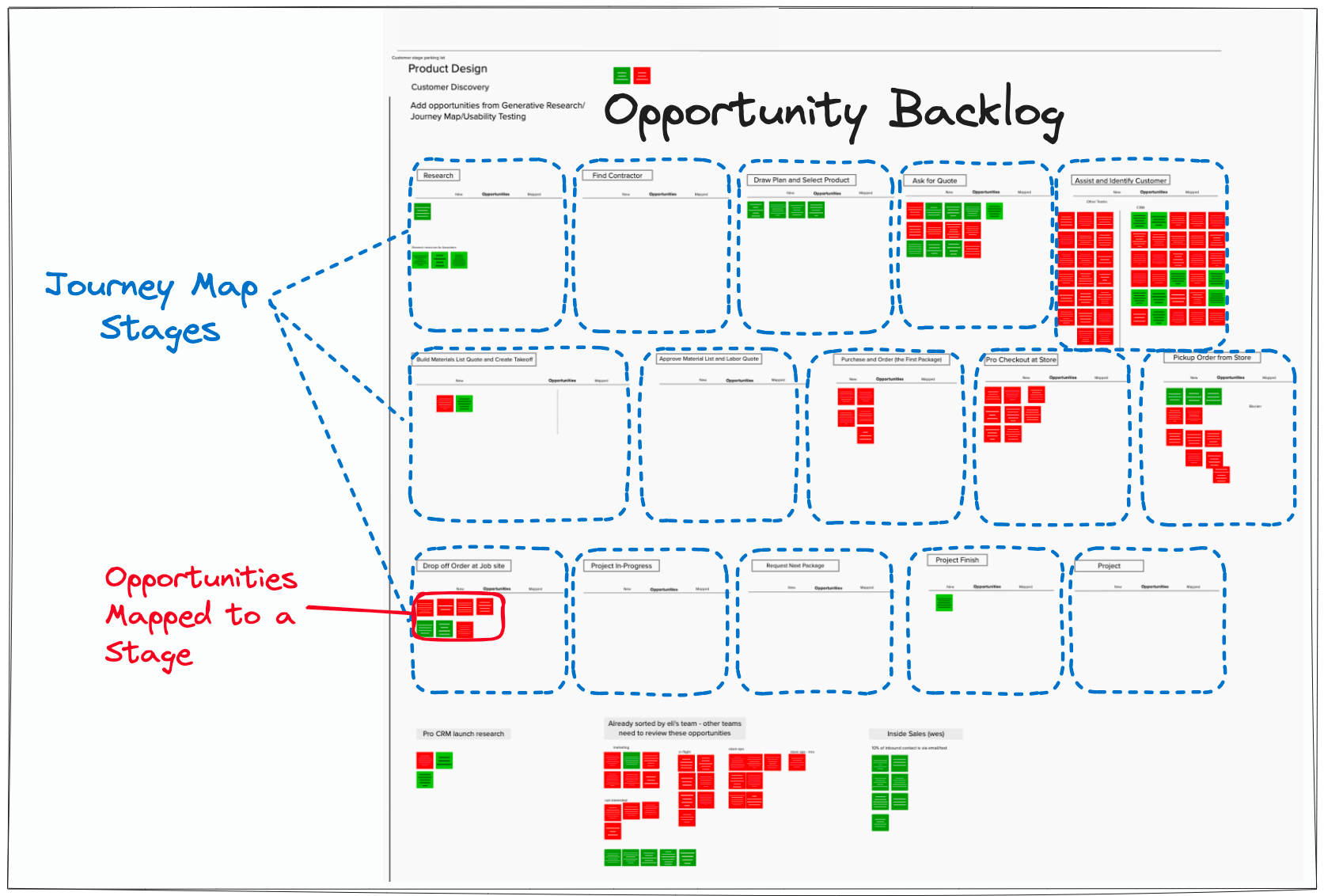

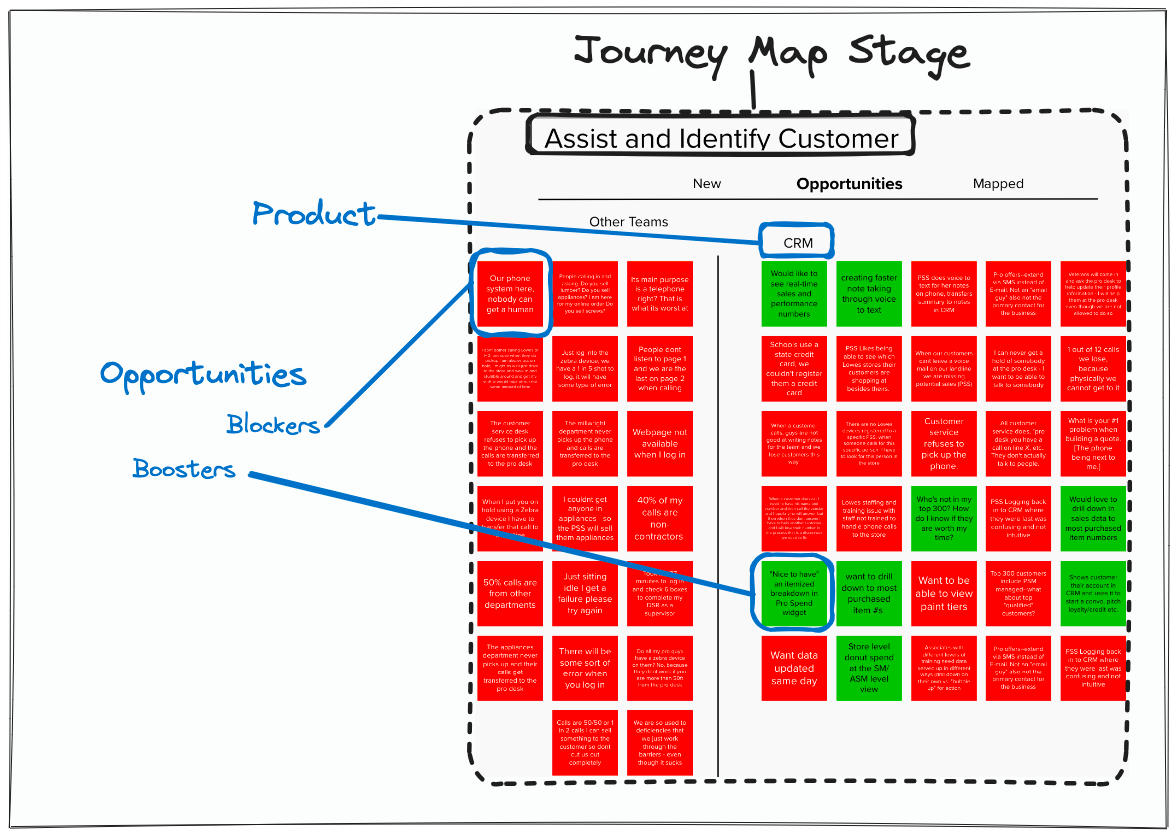

- Opportunity backlog: Every pain point and every critical reference made by a customer or Pro associate had to be logged and aggregated into themes. I would store the feedback in an opportunity backlog. I linked the opportunity backlog to the Pro residential contractor segment. Each piece of feedback had now become an opportunity, waiting to be assessed for a possible investment from the Pro Sales business team.

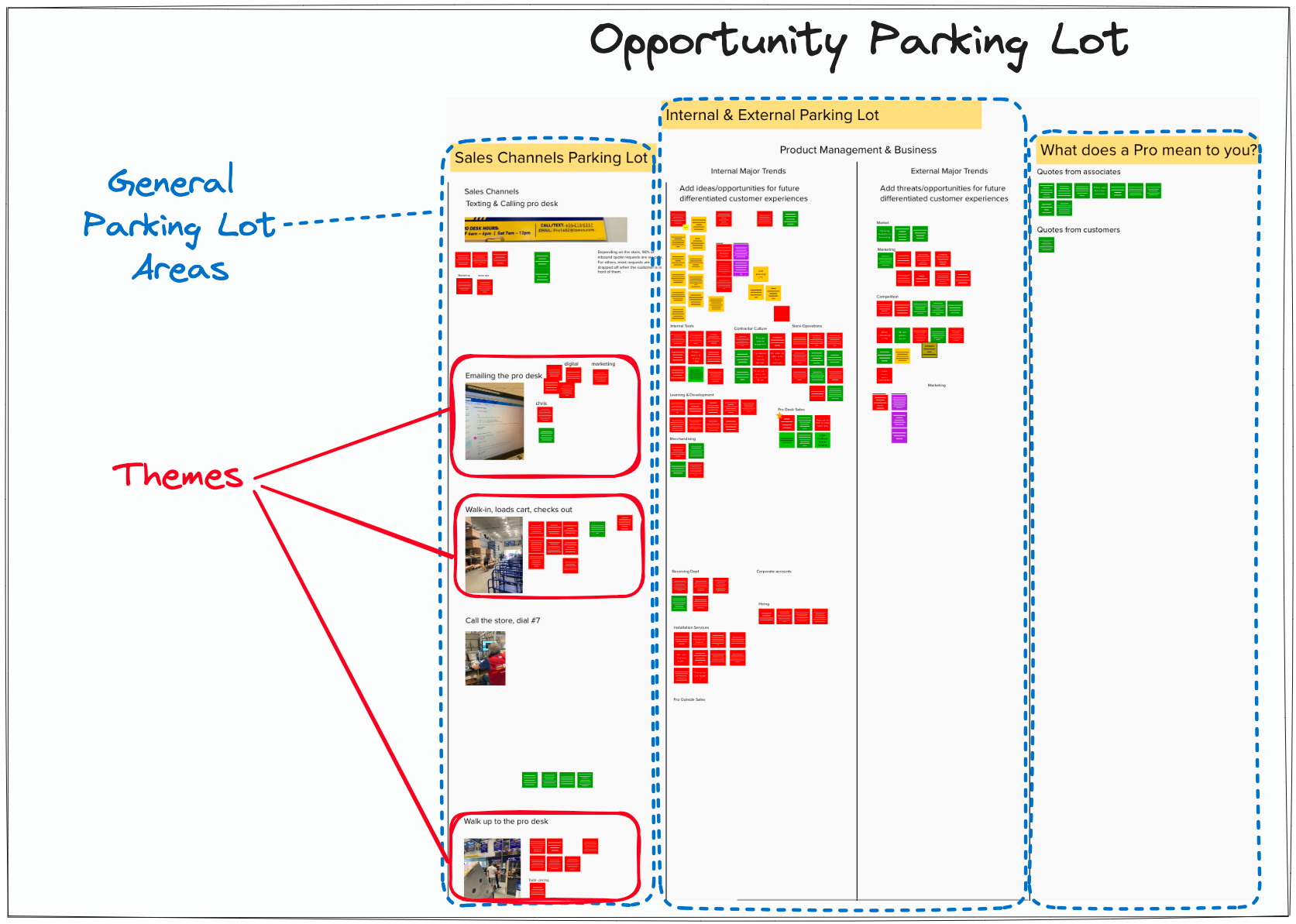

- Opportunity parking lot: I learned quickly that not all opportunities fit nicely into a specific customer journey map stage. Also, people unfamiliar with the VoC program wanted to add pain points based on customer feedback they'd received. This document was the perfect place to capture miscellaneous feedback.

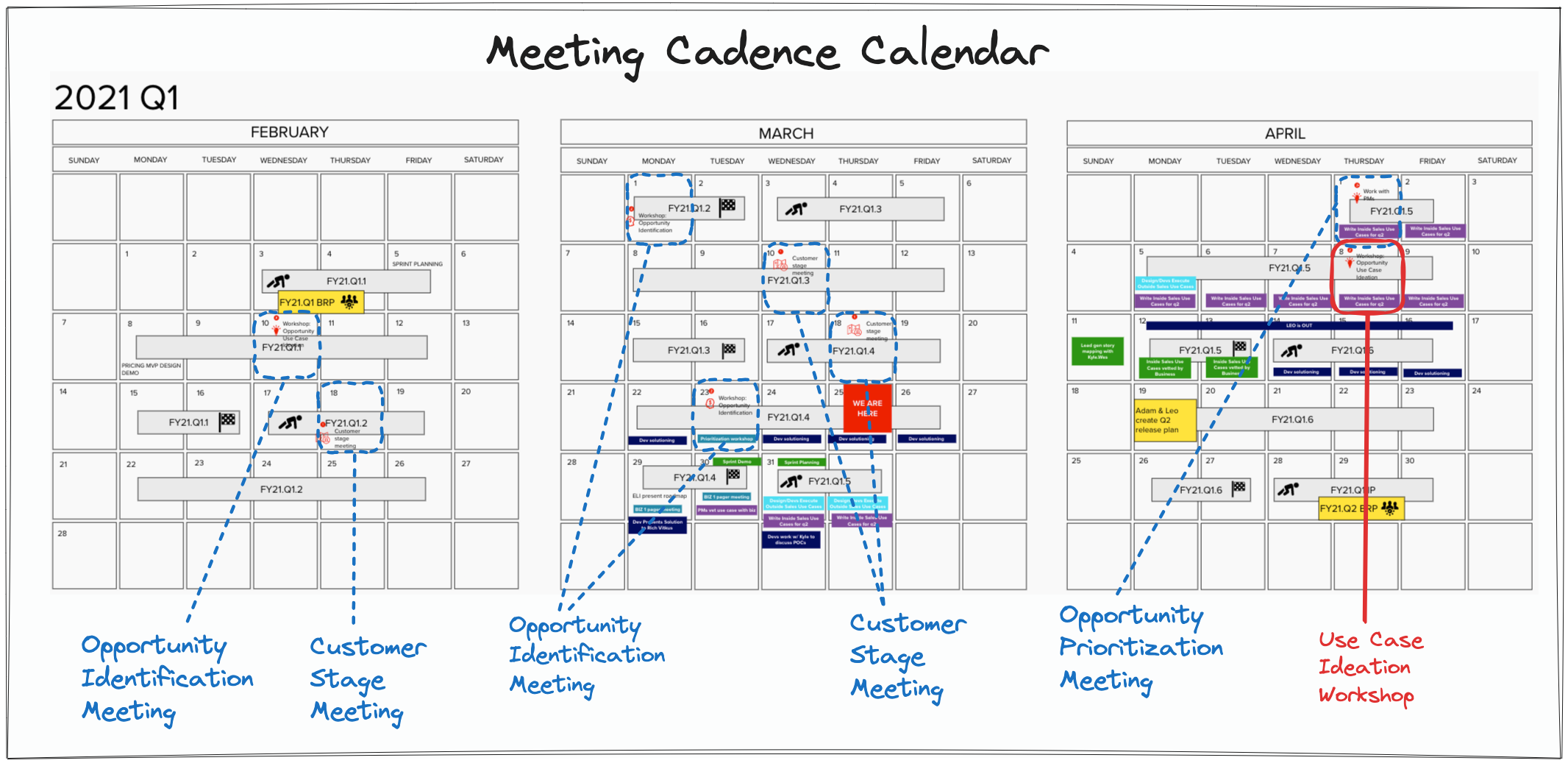

- Meeting cadence calendar: The VoC program requires several meetings a month. I created a 3-month meeting cadence for every quarter that the Pro portfolio team members would be invited to join. The meeting cadence calendar was a well-planned series of meetings that guaranteed all required team members would show up and participate. Shaping opportunities is a different cadence than the tactical agile ceremonial meetings.

- Continuous discovery process: I made sure that the Lowe's CUX design team could take an opportunity value statement that was selected for execution. We also had the operational skills to ideate on the opportunity via workshops, like use case ideation and user story mapping. I could run discovery and tactical work streams simultaneously.

Customer profile

Businesses sell to people. I focused on understanding every step of the Pro residential contractor and their project management journey. I knew that if Lowe's knew how the contractors went about their jobs, we could identify the correct investments to make in their customer experience with Lowe's.

I championed a true curiosity for the Pro customer and their behavior because I spent three months talking to them and the Lowe's associates. I was looking for opportunities that could move the needle and radically improve the customer experience. Sometimes I joked that I was mining for gold. But I was. I wanted to find nuggets and keep digging for more gold.

For some reason, the tech industry has latched on to the persona concept. I typically don't write up a persona profile because a persona is way too detailed. I prefer using archetypes since they are much more broad in describing a group of customers. So when I talked about the residential contractor, I focused on their journey and general behavior. This kept me from getting too detailed in discussions or other mundane tangents that would get me nowhere when evaluating opportunities.

Customer financials

I was very focused on the financial performance of the Pro customer segment. However, how we increase sales revenue and market share is where the Pro Sales business team and I clashed. I was focused on increasing transaction frequency and average order value (AOV) by improving how contractors could order building supplies online versus coming into the store or using a Lowe's associate to help place the order.

The Pro Sales business team was focused on improving the sales of the Pro desks across the U.S. by investing more money into improving the Pro desk business tools. From my perspective, improving the technology and business tools should be a percentage of the budget spend every fiscal year and be a part of long-term modernization projects.

I thought generating sales revenue by targeting key areas of the Pro customer experience for radical improvement would get us to grow our sales revenue and increase our market share much more effectively than predominantly investing in the store channel's operational sales process.

Customer journey map

The customer journey map is the primary CX document for a VoC program. Without a customer journey map representing the customer segment's visual and chronological interactive journey, I wanted to improve. I would not be able to run the VoC program that I ran from 2021 to 2022. I needed a source of truth that was not an opinion or some previous experience or insight about the residential contractor.

I wanted to close the contractor and the Pro product portfolio gap. I wanted us to be the most customer-obsessed portfolio in Lowe's. You cannot be customer-centric if you haven't asked your customers what they do every minute of every day and how Lowe's was involved in their contracting job. And that's exactly what I did. I pretended to know nothing about contracting and how contractors operated.

In the summer of 2020, I listened to contractors, Lowe's associates, and anyone else who had something to share with me for three months straight. I recorded conversations, observed people in their environment, and spent much time synthesizing data. I loved every minute of it. It was like I was mining for gold, and I found a gold deposit that had not yet been discovered.

The most important thing I could accomplish with this journey map was that I label all the stage gates and related touchpoints. The Pro Sales organization at Lowe's was heavily focused on the transactional stages of the residential contractor journey. This was reflected in the journey map because the amount of research data I mapped in the purchase stage is a lot more than other areas of the customer journey.

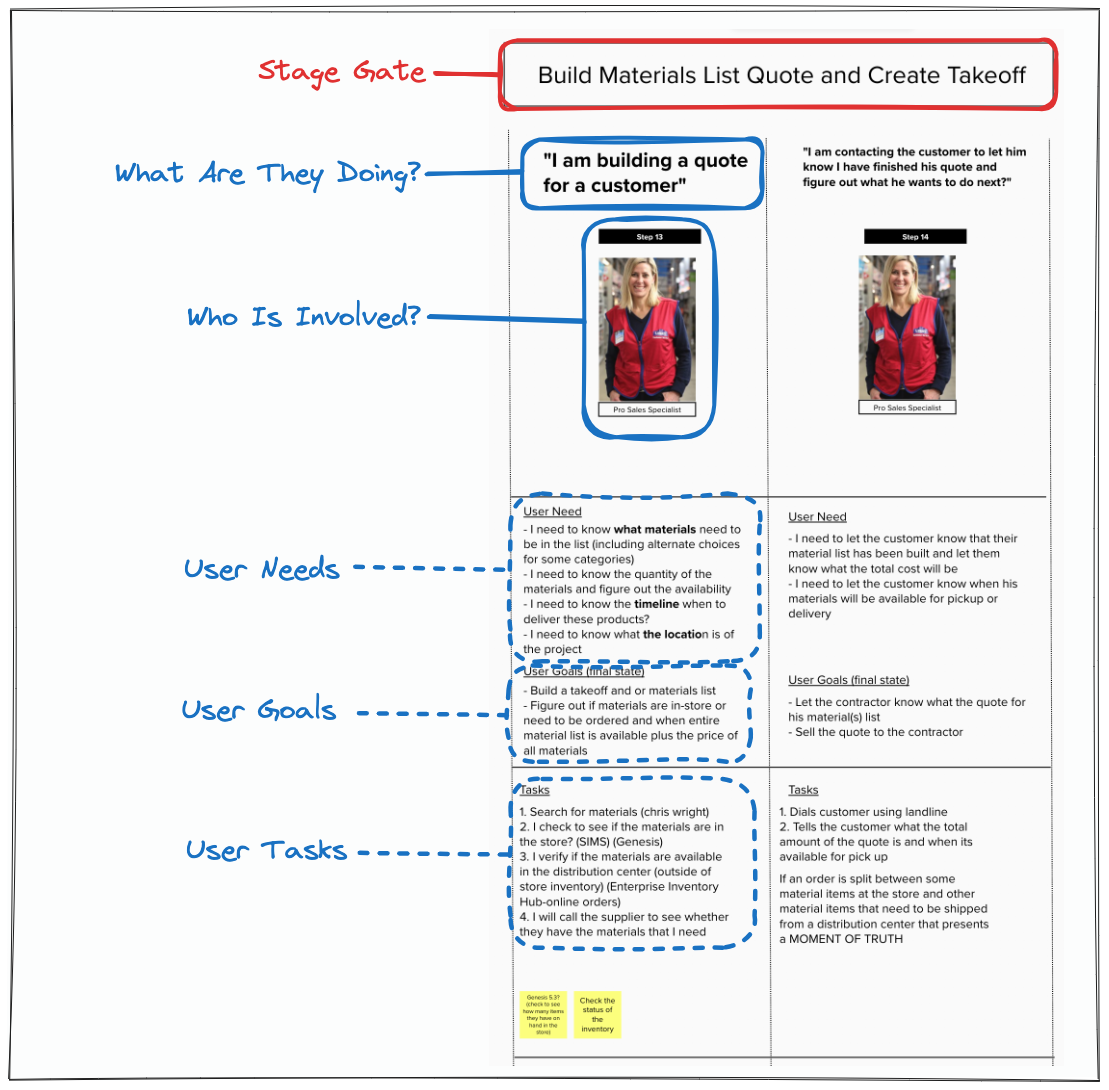

Stage gates

Due to the amount of customer data, I had mapped in this journey map, I tried to break up the journey by creating stage gates representing a group of tasks. By grouping tasks and giving them a name, I hoped to help my colleagues understand the residential contractor's buyers' journey with Lowe's.

You can read more on the concept of stages in this article.

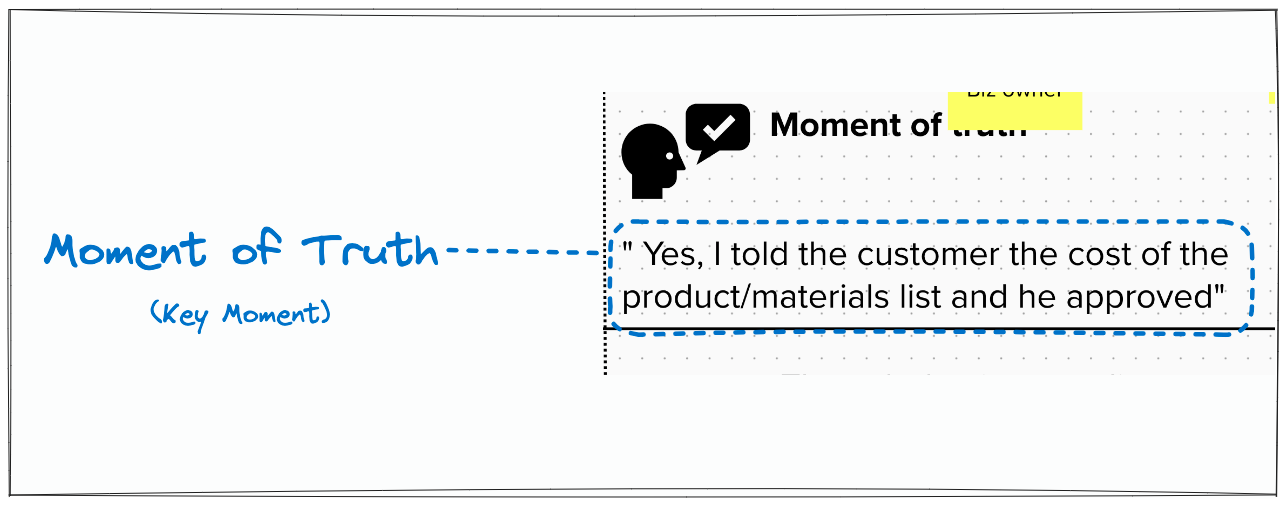

Moment of truth

I wanted to convey this statement that captured the most important moment in every step of the customer journey. All the tasks the people completed in my journey map led up to something, and I wanted the Pro team to know what those moments were.

If you are unfamiliar with key moments or moments of truth, read this article.

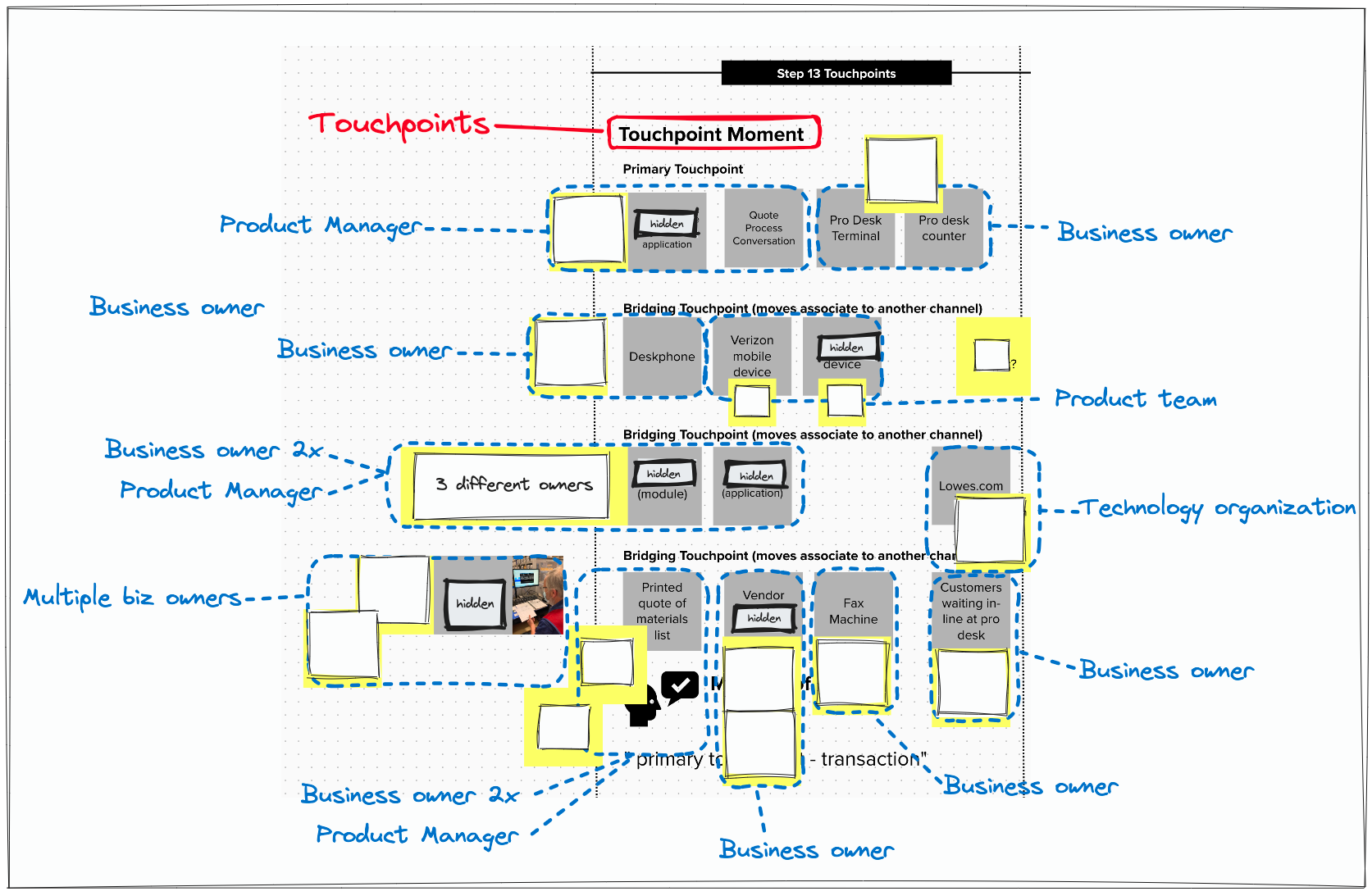

Touchpoints

When I mapped the touchpoints for all the different steps in the residential contractor journey, it became apparent how matrixed Lowe's was as an organization.

For example, in the step below:

- There are 14 different touchpoints.

- Ten different individuals, teams, and organizations manage those touchpoints.

When I presented the journey map and pointed to the areas the Pro team owned, colleagues saw the customer experience through different eyes. They remarked how challenging it must be for our Pro customers to navigate our customer experience.

Are you interested in learning more about touchpoints in general? Read this article.

Opportunity backlog

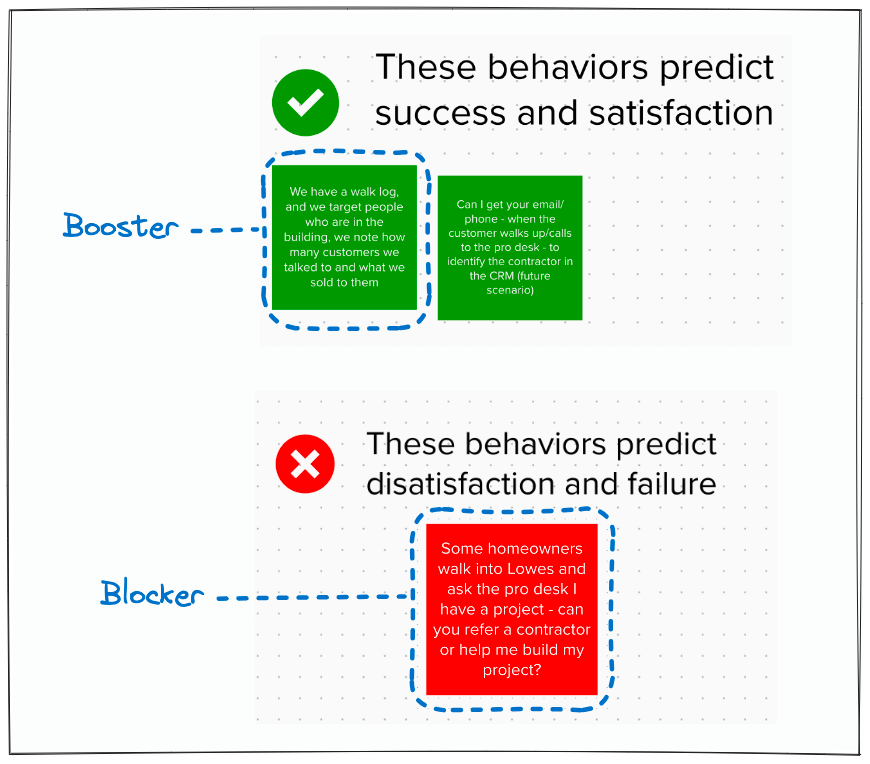

The second most important CX document that I created was the opportunity backlog. What is an opportunity backlog exactly? It's where I stored all the boosters and blockers I had identified through my research. But for simplicity's sake, I called them opportunities.

An opportunity is simply a potential investment the business can make to improve an area of the customer experience. Whether they want to do that happens in the investment strategy process is a different case study for a different day.

- A booster was something that customers loved about Lowe's when they interacted with the brand. Or it's something Lowe's associates did well. I wanted to note what we did well and see how we stacked against the competition.

- A blocker is something that does not meet the expectations of the customer. Somehow we failed them when we tried to complete a task, and we dropped the ball slightly. Or we had zero capability to help the customer complete their task.

Here's the thing, right now, there is no software that I've seen on the market that has the necessary capabilities to store opportunities. Some mentioned whether they could store these opportunities in Confluence or Jira. After reviewing the capabilities of both tools, they couldn't accommodate the volume of opportunities. , I had to store the opportunities in such a way that they were mapped to the customer journey map and its stages.

That is very difficult to do when Jira and confluence are table-based software tools. No, I needed a large canvas to house all my data, and I needed it to be accessed by many people at the same time and move the opportunities around.

So, as a result, I used Mural, a visual collaboration whiteboarding tool, to store all my opportunities. In Mural, I would take all my synthesized research and add it to stickies and map those stickies to the stage in the customer journey map that I thought was most accurate.

An example of a booster and blocker

I used green stickies to denote boosters and red stickies to display all the blockers and pain points. Color coding stickies keep it simple and organized.

Adding opportunities to a customer journey stage

After I synthesized months of customer research, it felt good to add opportunities and map them to the correct area of the customer experience. Mapping opportunities this way was a big change for a lot of people. I moved the Pro portfolio away from being product-centric and moving to a customer-centric way of thinking.

It also allowed the broader Pro team to see bigger themes across areas of the residential contractor's customer journey.

Opportunity parking lot

If you've done a lot of research like I have, you quickly realize a percentage of opportunities don't fit neatly into a stage or area of the customer journey map you've built.

This happened to me when I built the contractor journey map. So I decided to create a CX document called an opportunity parking lot. It acted as an upper funnel, a catch-all document where I could store blockers or boosters I couldn't quite map to a specific area in the customer experience.

In the image, you can see I've divided the parking lot into three different sections:

- Sales channels parking lot

- Internal and external parking lot

- What does the Pro mean to you?

Sales channels parking lot

I learned that when you operate in an omnichannel environment, you will always learn about pain points that cover all sales channels. I wanted to capture those because I was constantly looking to group my opportunities into themes to make it easier for my team to understand the broad strokes of investment themes in the contractor journey.

Internal and external parking lot

I tried to map pain points and link them to internal and external major trends. This parking lot tried to capture the cultural beliefs of both customers and Lowe's associates. I go beyond the cookie-cutter approach of jobs-to-be-done (JTBD). A good researcher captures his interviewees' moods, feelings, and sentiments.

Think of this type of parking lot as a pulse check. I was very sensitive to people's beliefs about how work should be completed. What should working at the Pro desk look like, for example? Why do you believe this? As for the contractors, I was keen to listen to their opinions and beliefs about the future of contractor work. This played into my research of trying to understand Lowe's brand reputation. I tried to understand this from the perspectives of Lowe associates and contractors.

Much of my research was conducted far from North Carolina and Lowe's HQ in Mooresville. This gave me a chance to talk to people outside of the bubble in North Carolina and get a fresh perspective that was not heavily modified by the presence of our corporate offices. Companies are made up of people. Our customers are people. I tried my best to penetrate what lay below the surface of everyday interactions to paint a picture of what was happening in the stores and communities where our customers worked.

Meeting cadence calendar

How would I involve the entire Pro portfolio product team in my VoC program? How could I ensure that everyone would show up for every meeting? I knew their calendars were full of meetings that either involved sprint-related meetings or meetings with the business team and planning ahead. To solve this problem, I created a VoC meeting cadence calendar.

I built my VoC meeting cadence calendar using these steps:

- In January of 2021, before Lowe's FY21 on February 1, I mapped out the sprints in a quarter in a calendar template in Mural.

- I mapped important events that happened every quarter in our product portfolio.

- I got confirmation from product management that the sprints and quarterly planning dates were accurate and correct.

- I mapped all my VoC program meetings so they didn't interfere with our quarter work activities. This was key because nobody was available some weeks and certain days, and I had to work around that.

- I created templates for each meeting to show them to people. I did this because people wanted to know what was happening during these meetings. (They wanted to vet the meeting before it happened)

- I presented this to my product management and design peers and got their buy-in. This gave me the green light to evangelize it with all the product managers and designers.

- I went on a roadshow and explained to every PM who was required to be there what the purpose of this program was and why I needed them to participate. You see, I showed all the PMs what I was doing, but not all of them would need to participate because some products were overhauling areas of their tech stack during certain quarters and did not need to participate.

- I presented the meeting cadence to the Pro Sales business team, who indicated they were mostly interested in the opportunity identification and prioritization meetings.

- I spoke with some of the engineering managers about the meeting cadence of the VoC program. They appreciated my efforts to reach out and explain what we were doing in the Pro portfolio to improve our planning. However, they indicated they were mostly interested in the opportunity prioritization meeting and did not feel it was valuable to attend the other meetings.

- On February 10, 2021, I kicked off the VoC program and met with all required team members from the Pro product portfolio. I recall we had around 20 team members attend, and it was the start of a very successful program that fundamentally changed how we operated.

VoC cadence meetings

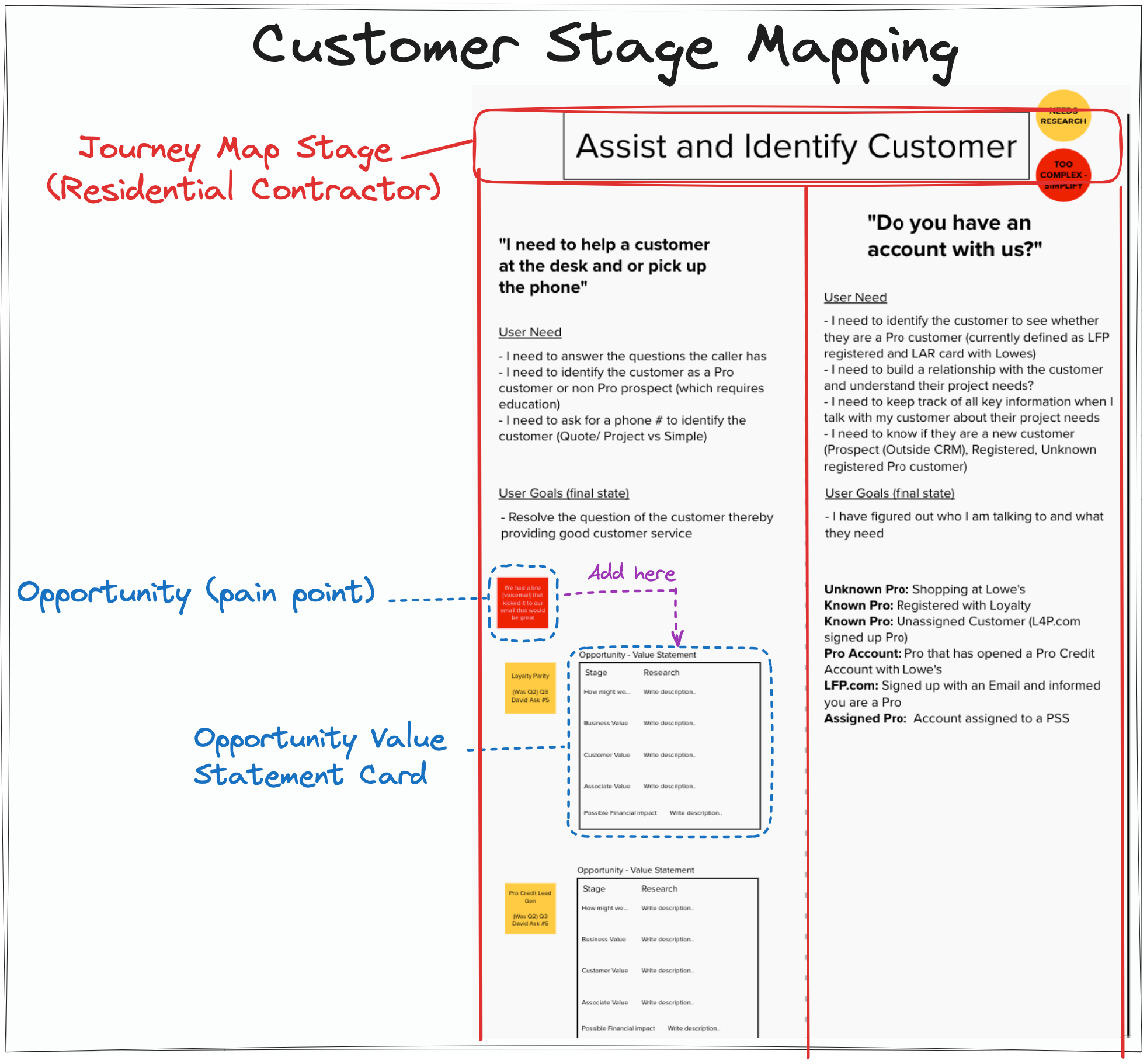

Meeting 1: Journey map stage meeting - As a team, we would move the opportunity (pain point) from the opportunity backlog or parking lot and assign it to the correct stage in the Pro residential contractor journey map.

This was important because it told the team responsible for managing this opportunity through the VoC program process. It also gave the responsible PM an idea of how many opportunities sat in their journey stages.

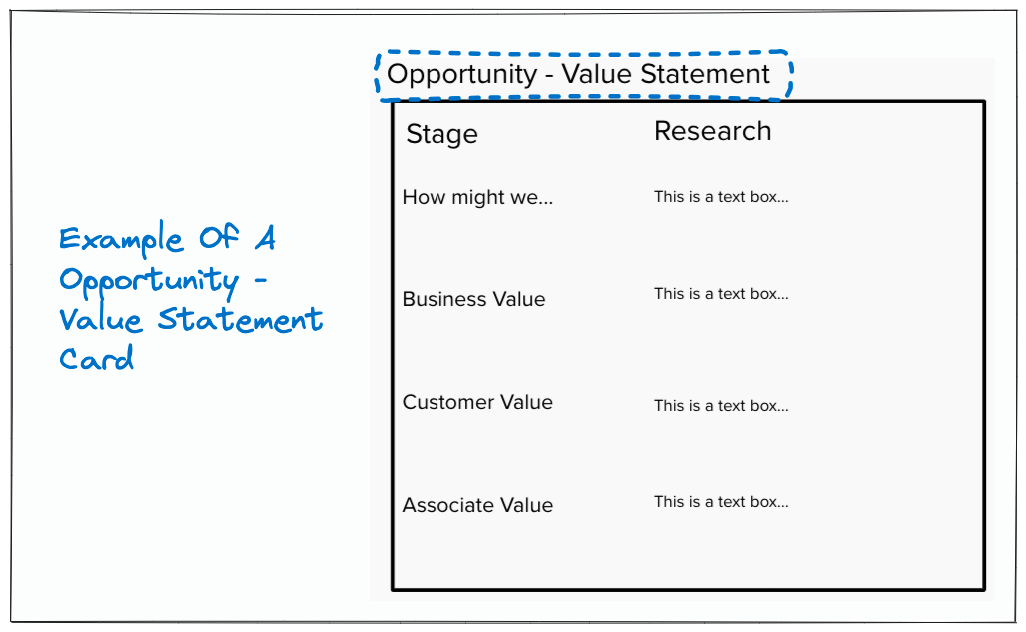

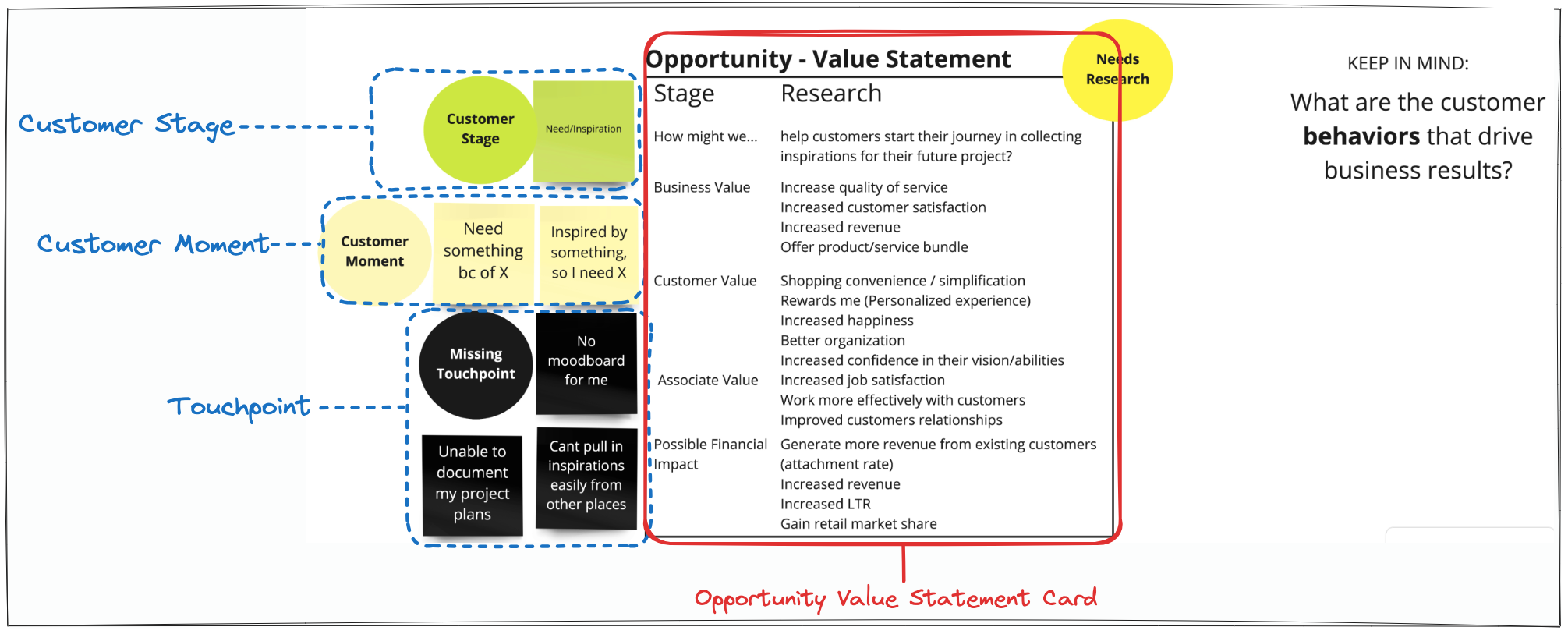

Meeting 2: Opportunity identification meeting - After we had mapped the opportunities to the correct customer journey map stage. I asked the responsible business member and PM, with the help of a product designer, to write out the opportunity value statement card.

Everyone enjoyed this meeting because they felt they were operating as a team. All functions were represented, and as they crafted the potential value of an opportunity together—there were no more separate meetings where other people were told after the fact about some opportunity they were going to pursue.

Here is an example of a completed opportunity value statement card.

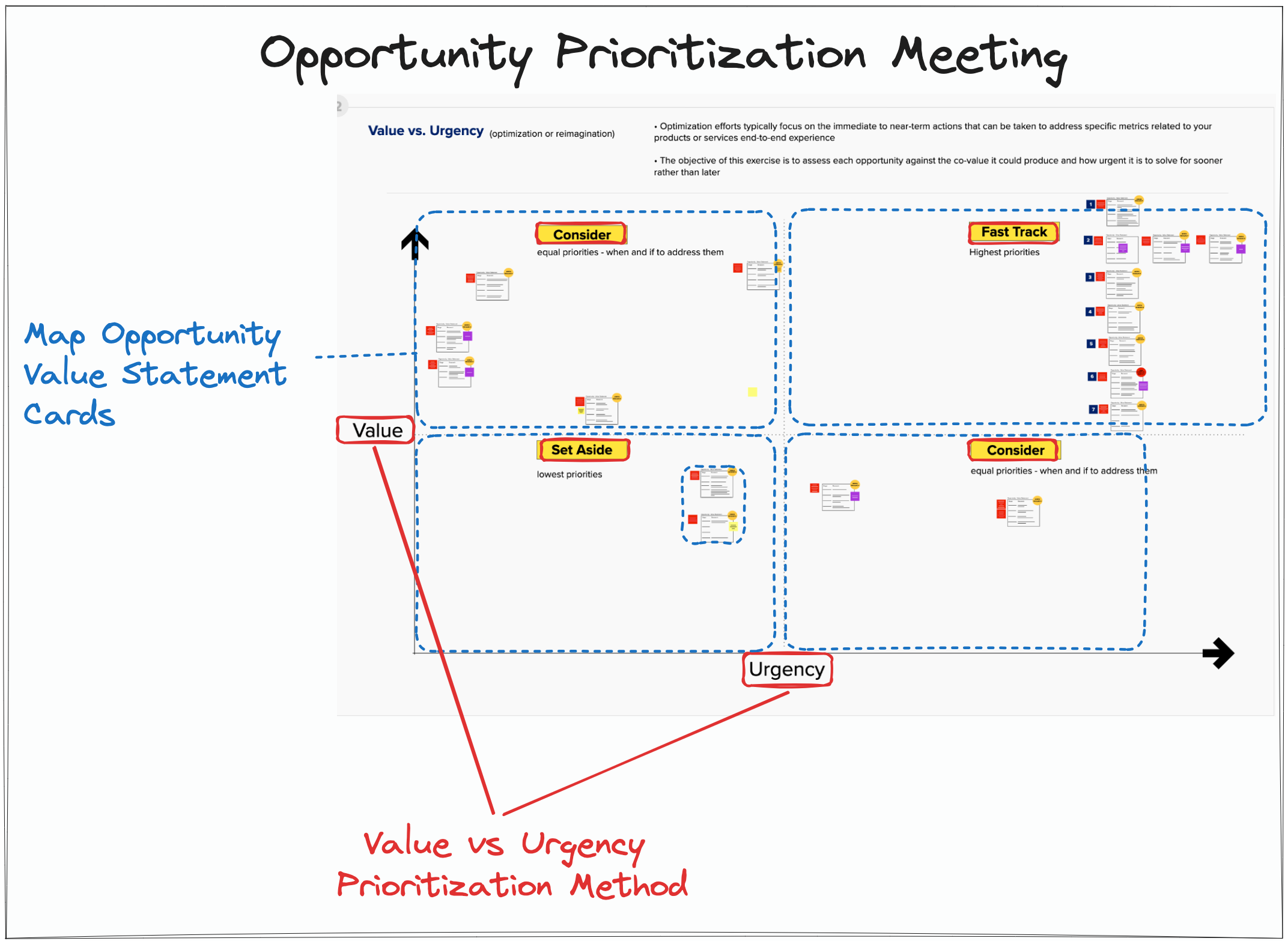

Meeting 3: Opportunity prioritization meeting - One of the critical tenets of the VoC program at Lowe's is that I wanted the business stakeholders in the same room with the product managers and product designers to discuss why they prioritized specific opportunities over others and explain their reasoning. This created a one-ness of mind and clarity on what was next regarding quarterly planning.

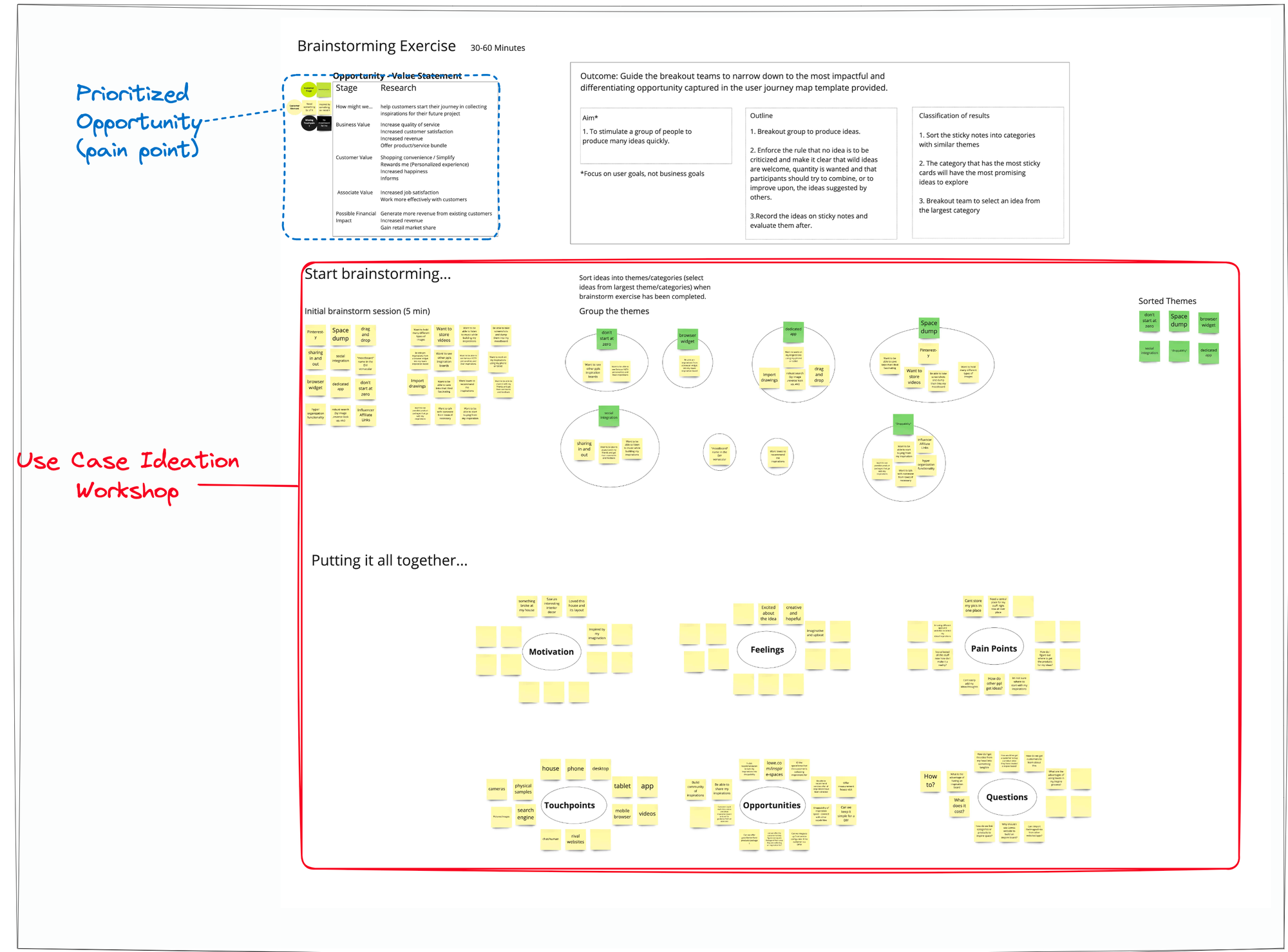

Meeting 4: Use case ideation workshop - After the team had identified opportunities to pursue, the design team determined whether research for an opportunity was required. We would decide on what type of workshop to generate a target state. These decisions were part of our product design process, and the team followed the steps in the process to get to the right outcome.

Continuous discovery process

I combined my product management and experience design knowledge to lead the creation of service experiences, from concept (opportunity) to production. It made a huge difference when an opportunity was first identified as a cross-functional team. Then as a team, we would write the value statement of that opportunity together and discuss how it would impact the customer or user experience.

Suddenly, defining target state customer experiences and requirements was made a lot easier, and ideating the first version of a target state took days instead of weeks or months.

I've heard many senior leaders talk about continuous discovery design and the need for this process in their organization. I've learned that running a continuous discovery process is a pipe dream if that organization does not have a functional VoC program. You cannot create a discovery process in an organization not centered around the customer. The best outcome is that many product teams create small improvements in their product but lack the coordination and vision to improve their customer experience radically.

Summary

It took me three months to research the contractors and the Lowe's Pro associates who sold them building supplies. It took me another two to three months to synthesize and organize the research into something actionable.

Then I created the most important CX document in the VoC program. The chronological visual journey of the B2B Pro residential contractor is their journey from getting hired to completing their residential construction project.

It took me one month to prepare and lay the foundation for the VoC program after studying customer experience management methods for almost a year during my weekday evenings. Then on February 10, 2021, I held the first VoC meeting as part of my VoC program.

I ran it for a year in the Pro product portfolio, which was part of the Store technology organization at Lowe's. Leading the VoC program turned the Pro portfolio into one of Lowe's most customer-centric product portfolios. Our design operations were functioning at a world-class level, and we incorporated continuous discovery that allowed us to explore new opportunities in days versus weeks or months.

Even though I was the primary driver of the VoC program and its concept, I was supported by a fantastic senior design manager named Jon Ochenas (Head of Customer Experience and Design at Oak Bank). Also, I want to mention Eli Wendkos, who, as director of product management in the Pro portfolio at the time, saw the value of this program and supported me every step of the way.

The months prepping to lay the foundation of this program and then running it for a year taught me that building world-class teams first starts with designing an organization with processes that put the customer first. After writing this case study, I am convinced that the path to profitability is centered on how customer-obsessed a company is. I sincerely hope this case study will help others who, like me, believe the path to profitability starts and ends with the customer.

Reflections and details

- VoC program are an effective resource allocator: grouping opportunities by customer segment and journey stages creates a more effective way to allocate resources versus grouping opportunities by product and independently assessing what it will take to make those features a reality.

- Voc programs generate strategic themes: leading the VoC program showed me how easy it was to show grouped opportunities that could be easily themed and added to an investment strategy process.

- VoC programs require different skills: running the VoC program requires people with skills to shape opportunities. This skill set is very different than general product development activities. I observed folks having trouble shifting from a builder mindset to a shaper mindset on several occasions. I realized that it would be more beneficial in the future to select team members who were naturally good at shaping business opportunities and who could visualize multiple concurrent target states in their minds and not get caught up in the current state of the customer experience.

- VoC programs focus on target states: because the VoC program looks into the future, you need people who have experience and understand how to create target states. Based on my experience, it was typically only very senior IC designers who were leads or principals who could operate in this fast-paced environment of continuous discovery.

- The VoC program is closely connected to the investment process: managing the VoC program, it became apparent I could use the program to push up important and addressable themes (cruxes) to be considered to be added to the strategic theme process at Lowe's.

- VoC programs are continuous discovery: I've learned that continuous discovery is a process that must be done with other product teams as part of a larger effort to improve a customer experience. Based on what I learned, it is too wasteful in terms of resource allocation to have a single product team run independent continuous discovery. The area they cover in a customer journey does not warrant this approach, and the impact, at best, is marginal.

- VoC programs should be part of strategic planning and research budget: a VoC program should be separated from the operational or product budget. You want to be able to have the VoC program operate on a 12 to 18-month timeline instead of the product team's three-month timeline. This gives the VoC program team the required time to formulate strategic themes and assess how portfolios can execute those themes and drive business objectives.

- VoC programs act as a buffer to the commoditization of product features: The reality is that your product features or services eventually become table stakes. There is no way around this, and your company has to be ready to deliver a differentiated product and service to maintain sales revenue. When you have a backlog of opportunities to explore and de-risk ahead of the commoditization curve, you won't be forced to take drastic action like layoffs or last-minute strategy adjustments.

Type: Voice of Customer program

Date: 2020-2022

Company: Lowe's

Role: Lead Product Designer

What I did: Customer insight gathering, data analysis, cross-functional collaboration, matrixed environment, customer feedback, business strategy, omnichannel management, opportunity identification and prioritization, writing opportunity value statements, opportunity backlog management, design thinking, understanding customer behavior, systems thinking, digital customer experience, driving revenue and customer growth, product management, experience design, stakeholder management, market research.

Team: Pro product portfolio (+8 products)

Tools: Mural, Confluence, Microsoft Teams, Roam

Get in touch

Thank you for visiting my case study. Please get in touch with me if you want to discuss any of my case studies and see an opportunity to work together.

I'm Leo, the writer behind The Triangle Offense blog. Diving deep into UX, CX, and customer-centric business strategy, I provide insights into using timeless CX and UX techniques to attract and retain customers to unlock business growth. Join me on this journey, and let's reshape how to grow a business together.